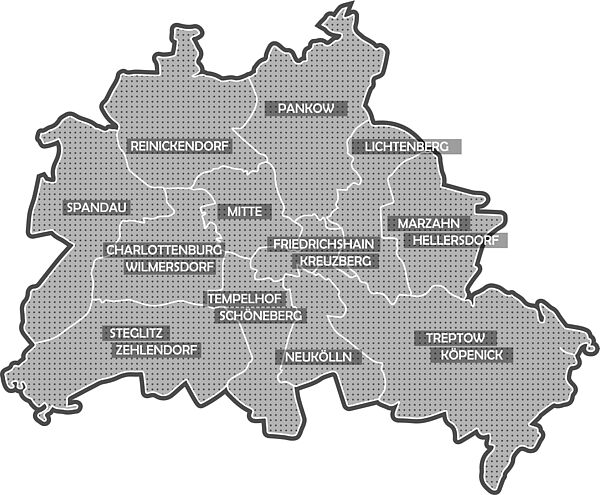

Portfolio analysis for the districts of Berlin

As the predecessor of Berliner Immobilienmanagement (BIM) (Berlin Real Estate Management), Liegenschaftsfonds Berlin managed the portfolio of state-owned land in Berlin until March 2015. Its tasks included the assessment, management, sale and rental of all real estate assets in possession of the municipality of Berlin. Liegenschaftsfonds Berlin also developed new usage perspectives for brownfield sites.

Task

The Liegenschaftsfonds Berlin issued a contract for the analysis, structuring and assessment of a representative sub-portfolio of around 1,250 assets containing properties evenly distributed in Berlin. These properties were to be assessed and analyzed in terms of value creation potential, marketing opportunities and concerning their segmentations and marketabilities. The properties with the greatest potential were to be assessed in terms of their market attractiveness and competitive advantages.

Approach

The first stage was the development of an analytical model with ensuing multi-stage analysis and structuring of the portfolio. The analysis identified those properties whose qualification measures afforded them high value creation potential. Following the analysis and structuring of the portfolio, around 130 properties with the highest value enhancement potential were assessed from a real estate point of view. Recommendations were offered for qualification measures. On the basis of a subsequent grouping of the properties, a targeted approach for potential buyers evolved.

Result / Added Value

The Liegenschaftsfonds Berlin received a thorough analysis and structure according to the marketing capability of its portfolio. With the qualification recommendations derived from this, the portfolio value could be increased by means of targeted measures.

By addressing potential buyers, it was also possible to actively generate strong investor interest.

Project Volume

Approx. €500 million